May 08 2023

Getting started with Online Loans Pilipinas

Best online loans

In this article:

► Introduction to Online Loans Pilipinas

► OLP's 0% interest on first loans

► Requirements and Application Process

► Loan amounts and interest rates

► Disbursement and repayment options

► Accessing your account and password safety

► Pros and cons of using Online Loans Pilipinas

► Alternatives to Online Loans Pilipinas

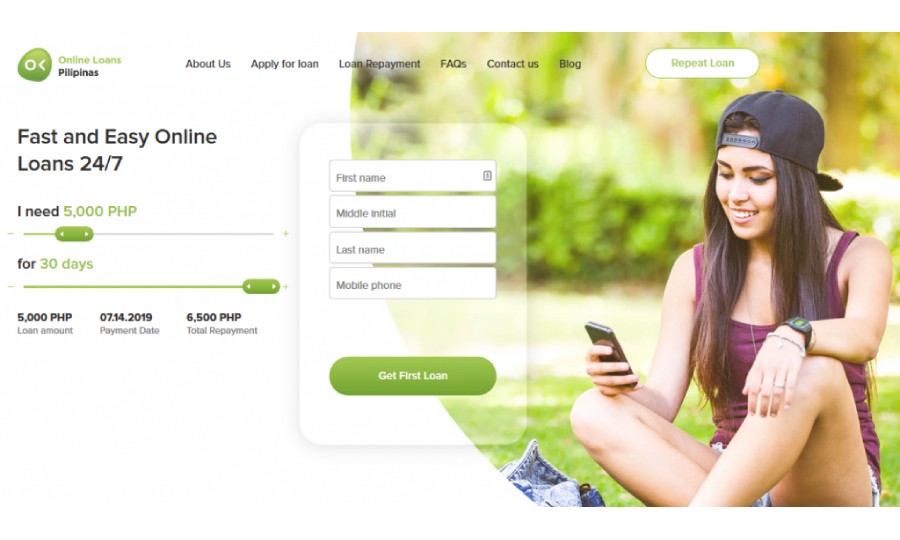

Introduction to Online Loans Pilipinas

Hey there! Are you looking for a quick and easy way to get a loan in the Philippines? Online Loans Pilipinas (OLP) might just be the answer you're looking for. They offer online loans for Filipinos who need cash in a pinch. In this article, we'll discuss everything you need to know about OLP, including their legitimacy, the application process, and the pros and cons of using their services. So, sit back, relax, and let's dive in!

Legitimacy of OLP

First things first, is Online Loans Pilipinas legit? OLP can be downloaded from the Google Play Store, and if you check their developer info, you'll find that they have the necessary licenses and registrations, such as an SEC registration. This is reassuring, as not all online loan apps display this information.

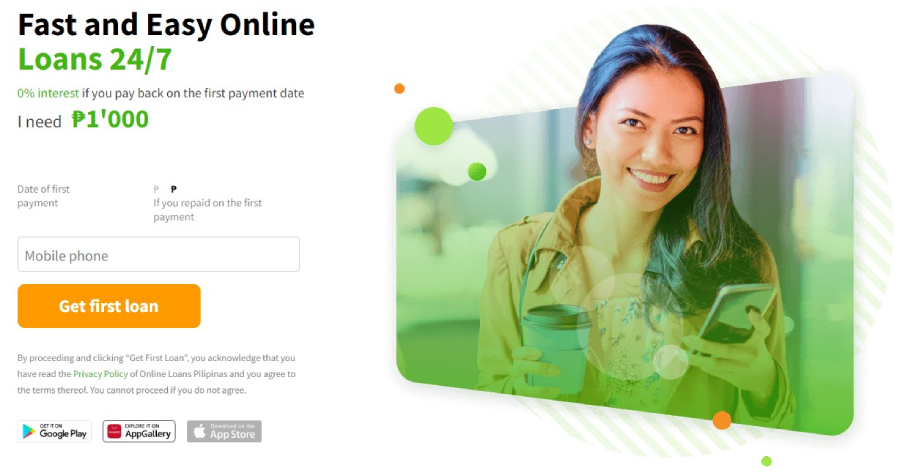

OLP's 0% interest on first loans

One of OLP's standout features is their 0% interest on first loans. However, it's important to note that this only applies for a short repayment period of one or two weeks. So, if you're a first-time borrower and can manage to pay back your loan within the given timeframe, you could potentially save on interest.

Requirements and Application Process

Documents needed

Applying for a loan with OLP is relatively simple. All you need is a valid government-issued ID, such as an SSS, PhilHealth, passport, PRC, or student ID. You will also need a bank account or a GCash account to receive your loan.

Loan amounts and interest rates

OLP offers loans ranging from PHP 1,000 to PHP 25,000, with no collateral required. Interest rates and repayment terms will depend on the amount borrowed and your credit history, so keep that in mind when applying.

Application process

To apply for a loan with OLP, simply download the app and follow the step-by-step instructions. You'll be asked to provide your full name, ID number, city of residence, email address, date of birth, and employment information. Additionally, you'll need to provide a selfie with your chosen ID, as well as a reference. Once you've completed the application, you can expect a response within a few hours.

Disbursement and repayment options

Once your loan is approved, you can choose between receiving the funds through your bank account or GCash wallet. The latter option is often quicker, as more people use GCash. Repaying your loan is also easy, as OLP allows for repayment through various channels, including online banking, GCash, and over-the-counter transactions at partnered banks.

Accessing your account and password safety

When creating your OLP account, you'll be prompted to create a unique password for added security. Make sure to choose a password that is not easily guessable and to keep this information safe. Do not share your password with anyone else.

OLP's customer service

If you ever encounter any issues or have questions regarding your loan, OLP's customer service is there to help. You can reach them through the in-app chat feature or via email. While they may not have a hotline number, their response time is relatively fast, and they usually address concerns efficiently.

Common questions and issues

Some common questions and issues borrowers may encounter include loan approval status, repayment process, and account-related concerns. Don't worry, though, as OLP's customer service is equipped to handle these queries and provide the necessary assistance.

Pros and cons of using Online Loans Pilipinas

Now that we've covered the basics, let's discuss the pros and cons of using OLP.

Pros

- Quick and easy application process.

- 0% interest on first loans (with short repayment terms).

- Flexible repayment options.

- Secure and user-friendly app.

- Responsive customer service.

Cons

- Interest rates can be high, depending on the loan amount and repayment terms.

- Limited loan amounts compared to traditional banks.

- No hotline number for customer service.

Conclusion

Online Loans Pilipinas is a legit and convenient option for Filipinos who need quick cash. With a straightforward application process, flexible repayment options, and responsive customer service, OLP has become a popular choice among borrowers. However, be cautious of the interest rates and make sure to read the terms and conditions carefully before agreeing to a loan.

Alternatives to Online Loans Pilipinas

If you're unsure about whether OLP is the right choice for you or you'd like to explore other options, there are a few alternatives to consider. Let's take a look at some of them:

- Tala Philippines - Tala is a popular online lending platform that offers loans ranging from PHP 1,000 to PHP 15,000. Their interest rates and repayment terms are competitive, and they have a user-friendly app. You can also access their customer service through their in-app chat feature or email.

- Cashalo - Cashalo is another lending platform that provides short-term loans for Filipinos. They offer affordable rates and flexible repayment terms. The app is also easy to use, and their customer service is available via email, chat, and phone.

- Robocash - Robocash is an online lending platform that offers instant loans with minimal documentation. You can borrow from PHP 1,000 to PHP 25,000, depending on your eligibility. They have a user-friendly app, and their customer support is accessible through chat, email, and phone.

- Loan Ranger - Loan Ranger is an online lender that provides cash loans with flexible repayment terms. They offer loans from PHP 3,000 to PHP 10,000, and their interest rates are generally lower than those of some competitors. They have a simple and secure website, and their customer service can be reached through chat, email, and phone.

- MoneyCat - MoneyCat is another online lending platform that offers quick loans to Filipinos. They provide loans up to PHP 20,000 with easy application and fast approval processes. They also have a user-friendly app, and their customer service is available via chat and email.

Tips for choosing an online lender

With several online lending platforms available, it's essential to consider the following factors before choosing one:

- Reputation - Check for reviews and ratings of the platform from real users. A reliable lender will have a good track record and positive customer feedback.

- Interest rates - Compare the interest rates offered by various platforms. Make sure you choose a lender with competitive rates that won't put a strain on your finances.

- Loan amount - Determine how much money you need and choose a lender that offers the right loan amount for your needs.

- Repayment terms - Make sure to understand the repayment terms offered by the platform, including the repayment period and any penalties for late payments.

- Customer service - Choose a lender with responsive and helpful customer service. In case you encounter any issues or have questions, you'll need a reliable team to assist you.

Remember, it's crucial to read and understand the terms and conditions of any loan you're considering. Always borrow responsibly and ensure you can repay the loan on time to avoid additional fees and penalties.

FAQs

Is Online Loans Pilipinas legit?

How long does it take to get approved for a loan?

Can I apply for a loan without a bank account?

How do I repay my loan?

What happens if I don't repay my loan on time?

Related articles