May 11 2022

Loan App Philippines 2022

Best online loans

In order to take out a loan in the Philippines, now you do not need to leave your home, given the constant growth of people who use phones for this purpose, companies providing loans have developed applications with which you can easily apply for a loan by downloading and installing it from the Google Play Market

Let's look at the most popular phone applications where you can get a loan online for the Philippines quickly and conveniently.

How to get loan via mobile apps?

Do you want to request a personal loan and are you looking for a good loan app to manage it in one click? In that case, we present the best options and their advantages:

What is a loan app?

A loan app is an application that allows you to request or manage a personal loan directly from the software, without the need to physically travel, talk on the phone or do any other management outside.

In the age of mobile phones and technology, it is a modality that is on the rise due to all its advantages:

- It's fast

- It is safe

- It is comfortable

- It is reliable

It is one more alternative to traditional banking. In fact, there are many fintech companies that already have their own loan app. Moneycat app is one of the best examples, since we are also the most popular finance app.

But what options are there? Below we will talk about some of the main loan apps that allow you to request extra liquidity:

Loan Apps

Currently we find different applications to manage loans; free, paid, for Android, for iOS…

The best loan app is undoubtedly Moneycat app. With our mobile or tablet application you can create an account for free, connect your accounts and find out about your financial health, apply for a loan and even create an account and a free card. All in one click. The most reliable, safe and fast option to request personal loans today.

There are many loan apps today that you can get for your smartphone. In the case of Moneycat app, it is one of the most downloaded and has a very top rating, a 4.4 on Android!

1. Online loans Philippines app

0% interest online fast peso cash loan app for the Philippines.

Get a special offer for new clients: as low as 0% interest and without other fees credit. The minimum interest rate is 0% and maximum APR is 180%.

For new and valued repeat borrowers: the loan amount is from ₱1,000 to ₱30,000.

Subject to evaluation, the credit term reaches from 90 days to 720 days, wherein the minimum repayment period is 90 days, and the maximum is 720 days.

For example, a borrower who took ₱5,000 for 90 days gets ₱5,000 and has to return ₱7,245 in 3 equal installments, ₱2,415 interest fees. No other debt payments.

Use quick cash advance unsecured lending money application for your urgent needs. Take money before payday, for medicine, gifts, and other financial needs. Apply for reliable and secure lender service when salary is not enough.

FAQ: conditions of the peso cash lending money app service

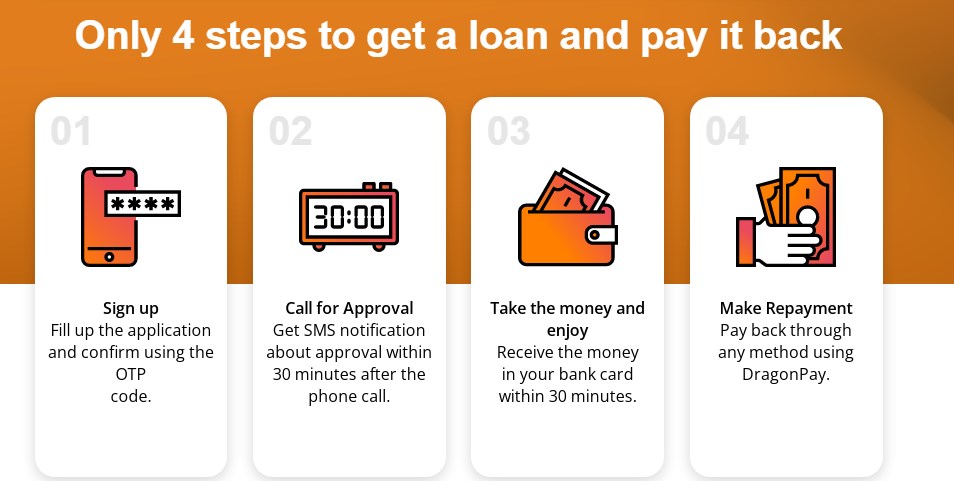

How to apply for an easy payday online loan via the app?

A very fast process to get cash advance:

- Use your device: a smartphone or a laptop.

- Download the OLP - Fast Approval Loan App.

- Select your loan amount.

- Fill the forms in 5 minutes.

- Wait for SMS or call for approval.

- Get the money from ₱1,000 - ₱30,000 pesos to your bank account or e-wallet (GCash and others). ₱30,000

Benefits of Online loans Pilipinas:

- Absolutely low 0% interest rate for every new client.

- No collateral – unsecured lending.

- No need to spend your time in-office visits.

- No inconvenience, use 1 id.

- No other fees for the first-time borrower. No need to pay anything besides a loan amount.

- Instant within 5 minutes disbursement after approval.

- Growing approval amount. Start a journey to significant sums of money, any time. Grow your financial shoulder from ₱1,000 to a significant sum ₱30,000.

Who can get a cash loan?

- A person is a Philippines citizen and 18+ years old.

- Has at least 1 id and has a mobile number.

- Has a job or self-employed.

What do you need to have to get a personal loan?

- Only 1 document. Choose from the list: Driver's Licence / GSIS / SSS / TIN / Passport / PRC / UMID / Postal ID / PhilHealth ID / Voters ID / PhilSys ID.

- A smartphone, a laptop, or a desktop and internet access.

- Banking account or GCash e-wallet.

For what purposes borrow money?

- Bills.

- Medicine.

- Bikes’ repairment.

- Gifts.

- Calamities.

- Leisure.

How to receive your peso loan?

Get money to your bank account or e-wallet (GCash and others).

How much time to wait for the money?

Get approval in 5 to 30 minutes. In most cases, you will receive an automatic SMS notification; otherwise, you will get a call. After approval, it takes 5 minutes to get cash with InstaPay.

How much cash can I borrow?

Our current loanable amounts for first-time applicants range are from are between ₱1,000 to ₱7000. Repeat borrowers in good standing can borrow up to significant sum ₱30,000.

How to make a repayment of your credit?

Upon repayment, use your reference number. You may choose among these options:

- Pay via E-wallets (GCash / PayMaya / Coins.ph) or Online Banking using Dragonpay.

- Go to any 7 Eleven and use the Cliqq machine via DRAGON LOANS.

- Visit any Bayad Center, LBC, Cebuana, SM or Robinsons Payment center, RD Pawnshop and Palawan Express using DRAGONPAY.

How tale a repeat salary loan?

Use the app or the site to get funds.

Credit app company information:

Address of the Financing company: Unit 1402-06 14th Flr Tycoon Center, Pearl Drive, San Antonio, Pasig City

Online Loans Pilipinas Financing Inc. (formerly Magic World Technologies Inc.)

The company is a legit Financing company, SEC Registration No. : CS201726430

Certificate of Authority #1181

2. Moneycat loans app

MoneyCat is a multinational finance company, now available in the Philippines.

⭐️⭐️⭐️SPECIAL OFFER⭐️⭐️⭐️

0% interest on your FIRST loan!

REQUIREMENTS:

• Just 1 VALID ID! Nothing else!

WHO CAN APPLY?

- 20-60 years old

- Filipinos currently living in the Philippines

- Employed individuals and selected professionals

HOW TO APPLY?

- Fill-up the application online in just 5 minutes and confirm using the OTP code sent through SMS.

- Answer our call to verify the information, terms & conditions.

- Receive the money in your account within 24 hours!

WHY USE MONEYCAT?

FAST

Only 5 minutes to complete the application!

SIMPLE

Just provide 1 valid ID and apply in 3 simple steps!

SAFE

Personal information is kept confidential according to the Company's Privacy Policy.

CONVENIENT

Download the app on your phone and apply from ANYWHERE in the Philippines!

How do I repay my loan?

Visit any 7-Eleven, LBC, Bayad Center, Robinsons Department Store, SM Payment Counters or ECPay Center. You may also pay online, use Bank Cash Payment or GCash. Please click https://moneycat.ph/page/howtopay for more information.

Apply for reliable and secure lender service when salary is not enough.

Get a special offer for new clients: as low as 0% interest and without other fees credit.

For valuable repeater borrowers:

- Minimum APR: 0% (for first online peso loan only!)

- Maximum APR: 36%

- Minimum period: 90 days

- Maximum period: 180 days

Representative example for 180 days:

The interest rate for using the loan in the first 15 days (interest-free period) is 0% per day (0% per annum), for the next 165 days, a floating interest rate is applied (from 0% to 36% per annum)

The loan cost is calculated:

Amount to be returned = Loan Amount + Overpayment Amount, where

Overpayment Amount = Loan Amount * Loan Period * (Rate in% / 100)

All applicable fees (including a processing fee of PHP 250) are already included in total cost of loan.

Example: You apply for PHP 20,000 and choose repayment over 6 months, your monthly payments will be only PHP 5,000 per month, your total cost of the loan will be PHP 30,000*. All applicable fees (including a processing fee of PHP 250) are already included in total cost of loan.

Address: 10F, Rockwell Business Center, South Tower, Sheridan, Brgy. Highway Hills, Mandaluyong City.

MoneyCat Financing Inc.

Company Registration No. CS201953073

Certificate of Authority No. 1254

3. Unacash loans app

UnaCash is one of the fastest and convenient loan app in 2022. Users can apply for a Credit Line which can be used for the Cash Loan, Shopping Installments and Lazada Wallet Credit!

Credit line usage:

- CASH LOAN

- Easily transfer your credits to your bank account after loan approval - LAZADA WALLET CREDIT

- You can also choose to shop at Lazada by converting your credits to Lazada Wallet Credits! - SHOPPING INSTALLMENT UP TO 0% INTEREST

- Using your credit, shop from our merchants which offer installment items; gadgets, beauty, fashion, automotive, home, grocery and a whole lot more!

More amazing features:

- Automated credit renewal

- Once you pay thru our convenient online payment partners, your credit instantly replenishes! - No hidden charges

- Get the full amount of your loan, UnaCash makes sure you get 100% of the cash/credit you need. - No Downpayment for shopping installment

- Shop from our Merchant Partners without any downpayment, we make sure you get the items you wanted without having to pay cash upfront!

Credit line amount:

- min PHP 2,000

- max PHP 50,000

Loan terms:

- min 2 months (at least 61 days)

- max 6 months

Number of payments:

- 2 times a month up to 6 months

Annuity interest rate:

- UnaCash Loan 13% per month (0.43% per day)

- UnaCash Credit Line from 0%

Disbursement fee:

- PHP 0

No loan disbursement and/or servicing included.

Early repayment available any time after loan disbursement.

Accrued interest cannot be cancelled in case of early repayment.

Late Payment. The payment made beyond the stipulated due date shall be charged with an applicable late payment fee, which shall be computed from installment due date up to the date of actual payment. The Late Payment Fee – PHP 800.

Penalty. Upon failure of the Borrower for any cause whatsoever to pay any of the payments when due (single or installment payment), the Borrower hereby acknowledges that the entire outstanding balance of the Loan Amount shall, without need of demand, immediately become due and demandable. Any and all unpaid and demandable installment payments shall be subject to penalty charges at the rate of 10% per month (0.33% per day) until fully paid. In the event of the Borrower’s default, the Borrower shall pay the costs of collection of the Promissory

Note, including reasonable attorney’s fees in an amount not to exceed 50% of the amount due and payable, which sum shall in no case be less than PHP 25,000).

Maximum APR: 157%

Minimum period: 61 days

Maximum period: 180 days

The online cash loan cost is calculated:

Amount to be returned = Loan Amount + Interest Amount, where

Interest Amount = Loan Amount * Loan Period * (Rate in %)

4. Tala loans Philippines app

Millions of happy customers worldwide have advanced their lives with Tala.

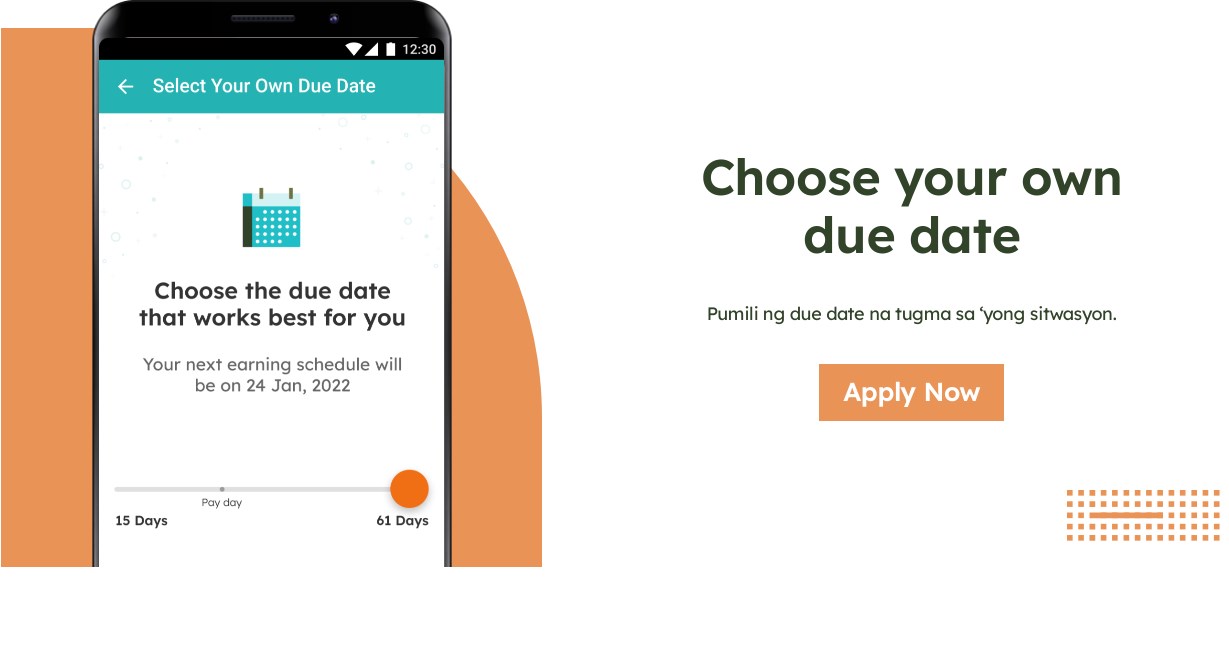

Get always-ready cash loans on your own terms with affordable fees. Apply through our secure app and get your approval decision in seconds. Choose your own due date and receive money within 24 hours via the method of your choice. Repay on time and you could double your limits in months.

KEY TALA FEATURES

AFFORDABLE

• Tala offers a low one-time fee as low as 9.5%

• Choose a repayment date that’s aligned with your income cycle to be set up for success

FAST

• Apply in minutes and get an instant decision

• If approved, get your money within 24 hours through Coins.ph app, at padala centers (incl. Cebuana Lhuillier, Palawan Express, M Lhuillier, and LBC), or your local bank

CONVENIENT

• Apply 24/7 in our easy-to-use app

• No paperwork, collateral, or bank account needed

• Only (1) valid ID required

FINANCIAL CONTROL

• Every time you borrow, you can choose up to 61 days to pay back

ALWAYS-READY ACCESS

• Repeat access to cash. Just pay back what you owe in full before borrowing again (some exclusions apply)

• Answer a few questions in the app and you are set to go

SECURE

• Tala secures your personal information with SSL encryption

LONG-TERM GROWTH

• Cash limits up to ₱15,000

• Most customers double or triple their limit in just months

REWARDING

• Earn ₱200 off the next time you borrow when you refer friends to Tala!*

HOW IT WORKS

• Download the Tala app

• Apply in minutes

• Fill out a short application and verify your identity using 1 ID and a selfie

• Choose your terms

• Confirm your desired amount, due date, and where to receive your money

• Get your cash

• Funds sent to your bank account, Coins.ph wallet, or nearest padala center

• Repay easily via GCash, Coins.ph, 7-Eleven, PayMaya, Cebuana Lhuillier, or M Lhuillier! Pay in full or make partial payments, anytime on or before your due date

• Borrow again

After repaying in full, answer a few short questions and be eligible to receive your next round of funds

WHO CAN APPLY

Any resident citizen of the Philippines, 18+ years old.

Has at least 1 valid ID and a mobile number.

RECURRING LOAN TERMS

Every cash amount we offer is eligible for a 61 day repayment period.

You will have continuous access to credit if you clear your outstanding balance and keep your Tala relationship in good standing (some exclusions apply).

Always study the terms and conditions and the disclosure statements before proceeding with any transaction.

RATES AND FEES

- Credit limit amounts: ₱1,000 to ₱15,000

- One-time service fee: 9.48%-27.03%

- Monthly EIR: 14.54%-15.00%

- APR: 170.5% -182.5%

- Late fee: one-time fee of 5% of outstanding amount due

- Applicable Tax (DST & GRT): 0.5% - 1.5%

- Minimum repayment period offered = 61 days

- Maximum repayment period offered = 61 days

- Example Fees: For a borrower who receives a ₱4,000 from Tala for our 61-day term, they would owe a 27.02% service fee of ₱1,080.95 and ₱59.05 in required tax for a total payment of ₱5,140.

- ₱4,000 (borrowed amount) + ₱1,080.95 (service fee) + ₱59.05 (required Tax) = ₱5,140 (total payment)

PRODUCT ENHANCEMENTS

We always work towards making our products better for our users. If you see offerings that differ from what is described above please don’t hesitate to contact us.

PRIVACY & PERMISSIONS

We will never disclose any personal information with anyone that is not you, without your permission, or sell your data to third parties.

Tala is operated by Tala Financing Philippines Inc., a licensed financing company (SEC Registration No.: CS201710582; TIN: 009-614-758; Certificate of Authority No.: 1132).

5. Goloan app

GoLoan – Get Online loan in Philippines for 0% for first Credit. Get cash loan to your bank account or G-cash account. Apply today and get up to 20,000 PHP loan.

The maximum interest rate per year is 183%

Maximum APR is 183%

Loan term: 90-180 days

Loan amount: 1000-20000 PHP

Simulation: borrower applies for 10,000₱ peso loan for 90 days. He gets 10,000₱ and has to return 14,500₱ in 3 equal monthly installments with 4,833 PHP monthly payments (including interest fees). No other extra debt payments required.

Why people love GoLoan – Fast Online Loans App?

- 0% interest rate for First Loan you get from us in free

- 24/7 online chat, email and phone customer support

- Fair loan conditions. We are fair and respect our customers

- High approval rate – 7/10 of loan applications are approved

- Online Peso loan up to 20000 Peso

GoLoan – why our online credits are reliable and good:

- No collateral and no paper work – get cash online within 1 day. No need to go to the office or branch

- Apply in just 5 minutes. Easy and fast

- Loan disbursal in 1 day. Need money today? Apply and get approved

How to apply for a loan?

Just use our mobile app and complete simple application:

- Download GoLoan App here in Google play

- Choose the best loan amount for you. First loan is on us – 0% interest rate.

- Loan amount up to 20.000 Peso

- Apply for fast peso loan in 5 minutes

- Your loan request will be reviewed and you will get money within 1 day

Who is allowed to apply GoLoan credits and installment loans:

- You are Philippines citizen

- Your age is more than 18 years

- You have stable source of income: job, business, freelance

FAQ about mobile loans apps in Philippines

How to install and get a loan from the google play market?

How to pay a loan in the application?

What is the best loan application?

Related articles