March 18 2022

What is a loan without collateral and guarantors, how to get it

Best online loans

El contenido del articulo:

► What is a loan without collateral and guarantors, how to get it

► Features of taking loans without collateral and guarantors in 2022

► What to look for in online lending without collateral in 2022

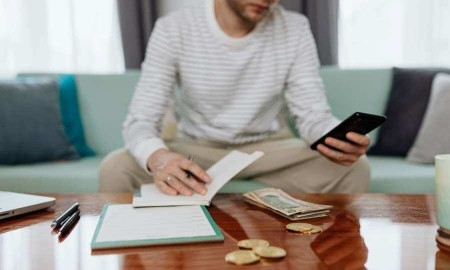

A loan without collateral and guarantors is an unsecured loan available depending on the income level, repayment period and source of income of the borrower. Most people are looking for these loans to use for personal needs as well as in case of unforeseen circumstances.

You can find microfinance organizations on our maxbank.com.ph website with a minimum package of documents, the best personal loan rates and a short online application approval time.

Here you can find the rates and duration of the loan to calculate the most optimal repayment amount for you.

Features of taking loans without collateral and guarantors in 2022

Today it is considered quite common to take a loan. Emergencies can happen to you at any time. With knowledge about loans without collateral, you will be able to quickly get out of your situation. Lenders are ready to approve your loan application as soon as possible.

What to look for in online lending without collateral in 2022

- Fast MFI Approval: These loans are approved quickly upon request. Lenders work quickly to approve your loan because they already know the level of urgency. They make the process hassle-free and you can apply for an emergency loan from the comfort of your living room or workplace, as long as you have a device that can connect to the internet.

- Easily accessible: this is one of the main advantages of these loans. Banks and other financial institutions generally cannot provide you with an unsecured loan. The only difference is in the conditions. Banks will require collateral and a high credit rating. Lenders are interested in your repayment ability. With us, you can choose the best offer to get an unsecured loan and use it for your urgent financial needs.

- Limited paperwork: For the best unsecured loan rates, you don't have to fill out a huge amount of paperwork or wait for your assets to be verified. Your lender can repay the loan amount if you meet their minimum requirements, which is usually a passport and TIN code.

What to do before applying for a loan

The main thing you need to do is to know the amount you want. You can follow the steps below to determine the amount you need:

- Have a budget: lenders are willing to offer you a good amount. However, this does not mean that you will agree to the entire amount offered by your MFI. You must understand your situation and calculate the amount of money you will have left after deducting your monthly bills. Part of this balance is the amount you have to use to pay off the loan.

- Calculate Your Monthly Payments: Once you have decided on the amount you want to borrow, you can use readily available calculators to check which monthly payment is right for you. At the same time, you can choose a convenient amount of monthly deductions and a period. A longer repayment period implies fewer monthly payments compared to a shorter period. However, you will end up paying more interest.

- Do a comparison between the offers of different MFIs: once you decide on a favorable amount and repayment period, we can put you in touch with different lenders. You have the freedom to choose from any reputable lender on our team. The comparison ensures that you get the competitive best personal loan rates that suit your financial needs.

Types of the best loans without collateral and guarantors

Lenders provide a wide range of personal loans, including vacation loans, home renovation loans, and auto loans, all of which work in the same way. You are offered an amount that you can repay within a certain period.

You need to find a reliable and certified microfinance institution that will give you a loan at competitive interest rates. In addition, you should have information that will help you recover from bad credit history and financial situation. When you decide to take an unsecured loan from lenders, it is useful to know that there are three types of loans:

- Debt Refinancing Loan: MFIs are willing to offer you a loan that you can use to pay off your total debt. This loan works by merging all your other loans and creating a total debt. This ensures that you get a new loan with a lower interest rate. You will stop worrying about different terms and interest rates. You will only focus on one fixed-rate monthly repayment.

- Secured Loan: You can choose to take out a loan and use your property as collateral. With security, your lender will give you a lower interest rate and a longer repayment period. This is usually risky because your asset can be confiscated at any time.

- Unsecured Loan: There are lenders who are willing to offer you a loan without any collateral. Most lenders only need a passport and TIN and a positive credit history before they approve your loan request. The downside to this is that you will have to pay a higher interest rate.

If you are facing major expenses and want to get financial help urgently, the best solution is to choose unsecured loans from lenders available in our list. We guarantee that we will select MFIs that will provide you with a loan without collateral and guarantors as quickly as possible.

With our wide network of offers, you can easily get a loan without collateral on favorable terms for you.

Related articles