February 01 2023

Loan statistics, prognosis and insights for 2023

Best online loans

In this article:

► Latest loan statistics in Philippines

► Loan financing in Philippines in 2023: advantages, tendencies, prospects

► Best strategies of getting a personal loan in Philippines for 2023

Latest loan statistics in Philippines

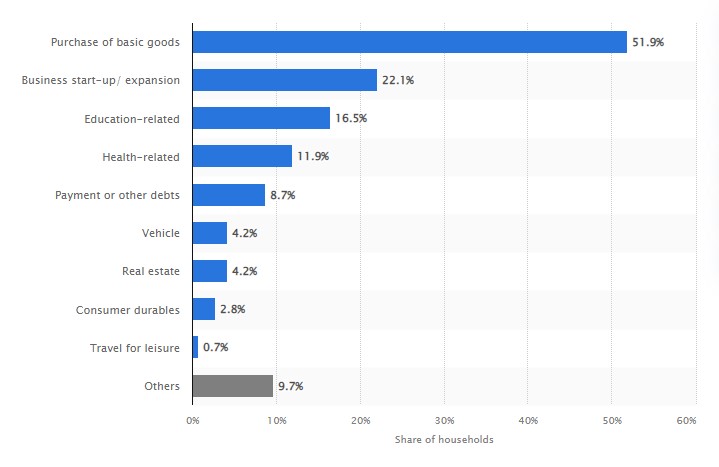

In 2023, loan statistics for the Philippines are likely to increase as more people look for means of financial assistance. Loans can provide much-needed aid to cover a variety of expenses including medical bills, cost of living, or even small business capital investment. Despite this, many individuals remain uncomfortable and ultimately risk-averse when it comes to taking out loans due to underlying concerns regarding repayment options and interest rates. Fortunately, recent developments within the banking and finance sectors have seen enhanced regulations in place with respect to loan agreements – all aimed at making the process far more transparent and thereby reducing anxieties associated with loan acquisition. With these structured legal protections in place, more lenders and borrowers can be expected to move into the market with better confidence in finding reliable long-term partners through responsible borrowing.

Image: Most popular purposes of loans among households in the Philippines during 4th quarter 2022 according to statista.com.

Financial sector in 2023

The World Bank has signed off on a $600 million loan to the Philippines that will help support its economic recovery and financial sector. This dynamic move comes as part of the World Bank's broader effort to strengthen the resilience of the region's economies in order to face possible economic adversities. The loan supports key reforms that are designed to create fiscal space for necessary investments in healthcare, education, and other essential sectors while sustaining macroeconomic stability. The aim is also to help facilitate financial sector governance along with greater efficiency, transparency and effectiveness. As part of this package, $150 million is dedicated entirely to supporting pandemic response and social protection measures that are essential for containing prices during ongoing market disruptions. All in all, these advances will surely put the country in good stead as it takes strides towards simultaneous economic recovery, development and financial stability.

Loan financing in Philippines in 2023: advantages, tendencies, prospects

By 2023, loan financing in the Philippines is set to undergo major transformations. Low-interest loans and government assistance will become more accessible while loan offers and terms of repayment may become more flexible across various sectors. Banking institutions are investing heavily in technology, which means citizens of the Philippines will be able to apply for a loan with ease. Moreover, numerous new fintech solutions are emerging on the market, providing fast and convenient services related to loan disbursement, collection and management tools. These services offer reoccurring payments plans and installment options that make loan repayment easier than ever before. Loans taken out for consumption can help sustain livelihoods as well as small businesses by providing funding for goods and services within the country’s economy. Loan financing in the Philippines is thus becoming increasingly accessible, user-friendly and beneficial - making it an important part of financial growth in 2023 and beyond.

If you're looking for a fast loan, check out the offers from Online Loans Pilipinas . This money lender offers quick loans from 1000 to 30000 PHP for up to 2 years.

Best strategies of getting a personal loan in Philippines for 2023

- If you are looking to get a personal loan in the Philippines this year, your best bet is to do careful research of the various lending options.

- Comparing the different interest rates, repayment periods, and loan amounts available will allow you to make an informed decision on which lender best suits your needs.

- It's also important to figure out what kind of documents you need; having all relevant documentation available up-front when applying for a loan will help speed up the process - no one likes long waiting times!

- Finally, don't forget to check if you have any pre-existing outstanding loans or obligations that may affect your ability to get a loan.

Planning ahead can go a long way towards ensuring success in securing a personal loan in the Philippines in 2023.

Related articles